Know This

Texas is a community property state. If the only owners of the LLC partnership are the married couple they do not need to file the information return for partnerships. All of the income and expenses go directly to their 1040 at the end of the year. They do, however, need to file the Franchise tax return with the Secretary of State like any other LLC entity. And that's true even if it's a Sole Propietor LLC

Before you buy into solar pannels know this: The credit is only up to 30% of your total cost. Example: if you pay $30,000.00 for the solar pannels you can only deduct 30% or $9,000.00 on your tax return. But this deduction is limited to your tax liability, which could be much lower than $9,000.00, and dependes on your taxable income. Example: if your tax liability is $1,500.00 then you can deduct $1,500.00 this year and leave the other $7,500.00 for future years. Get all the facts before making any large investment or purchase.

Recents scams have been getting information from Bank Of America customers. Make a police report and ask for your money back from the bank.

Here's some info on this year's tax rules.

Your property taxes may just drop this year and you can thank Governor Greg Abbott for it.

You may qualify to receive this benefits if you need help paying for health insurance. Follow the link to see if you qualify.

To qualify you must buy it for your own use, not for resale, and use it in the US. That's it!!

If you take care of your children or other dependents, you can get up to $500 per dependent if you qualify

If you have a child under the age of 17 you may receive up to $2000 per child if you qualify

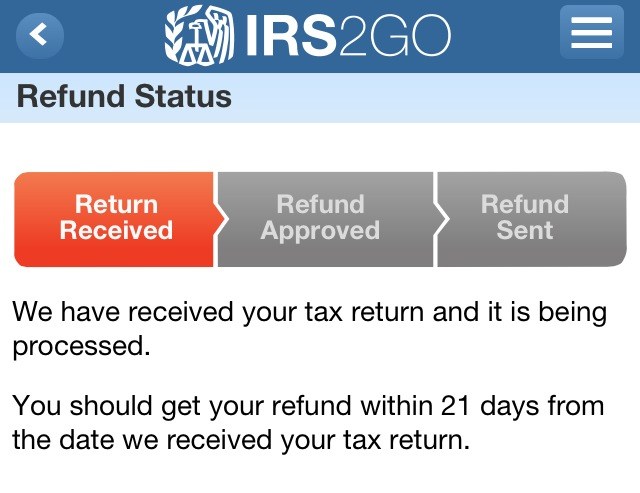

If you haven't receive your W2 or 1099, call the IRS at 800-829-1040 they will help you get it.

If you are itemizing deductions you may need to find the sales tax for your location.

Free Dektop and Mobile Apps

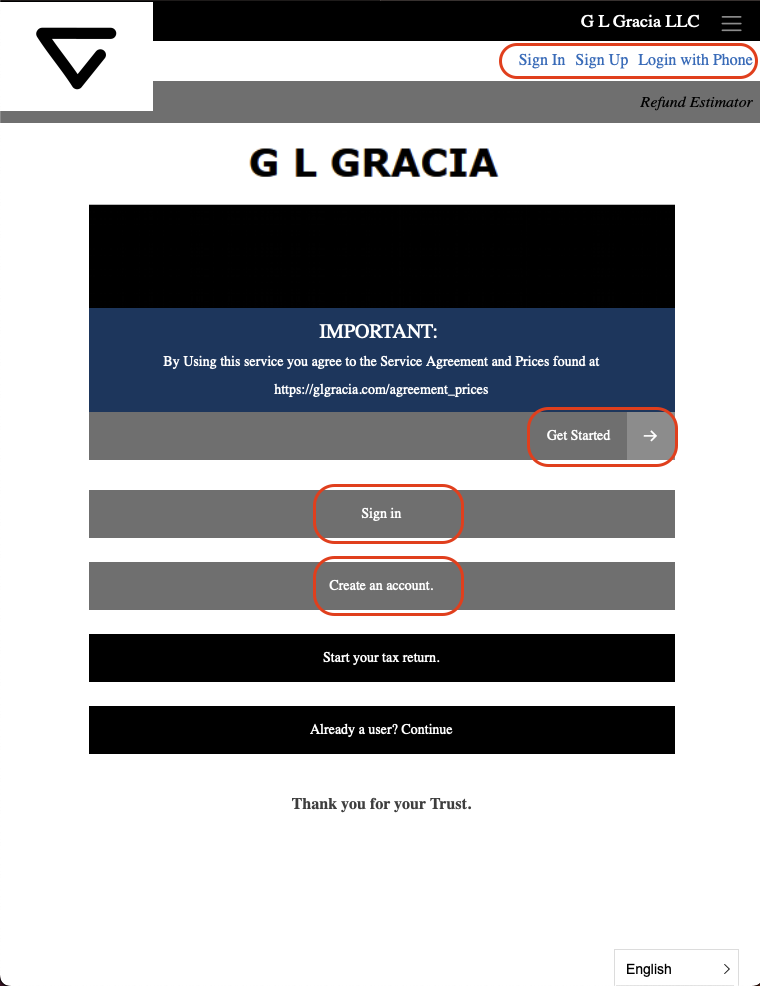

Service Agreement

Dear Client,

By using our services you automatically agree to the following Service Agreement and all its provisions.

All services are a la carte, and are performed following the price schedule found in G L Gracia’s website. Please contact us if you would like to execute a contract for continuing service, instead of pay per project.

All information needed for the service in section 9 shall be sent from the Client to G L Gracia, LLC by email or mail or hand delivered. Text is not an acceptable form of sending and receiving sensitive information.

Following are the terms of the agreement:

1. THE PARTIES. This Engagement Letter (the “Letter”) confirms the services of G L Gracia, LLC requested by you (the “Client”) on the date accorded by both parties in writing or verbally. Whereas the Client and G L Gracia, LLC (the “Parties”) agree to the following terms and conditions for the services, as an independent contractor, in exchange for fees

2. SERVICES. G L Gracia, LLC agrees to provide the selected, or requested, services (the “Services.”):

- Tax Preparation for Individuals

- Tax Preparation for Sole Propietors

- Tax Preparation for Partnerships

- Bookkeeping

- Electronic 1099 and W-2 filings

- LLC Creation or Dissolution

- State Sales and Franchise Tax Filing

- IFTA Quarterly Filings

- IRS Representation

- Notary

- Other services by request

G L Gracia, LLC shall conduct the Services within the specifications and guidelines set by the Client. G L Gracia, LLC shall, at all times, observe and comply with generally accepted bookkeeping and accounting practices and standards while complying with all Federal and State laws, regulations, and procedures when completing their Services in accordance with this Letter.

3. FEES. The Client agrees to pay G L Gracia, LLC:

- Fees agreed by both Parties following the current fee schedule.

- In the event that a project is required extra time or filings, both parties will agree on the fees required to complete the project or decide to withdraw from the agreement.

- In case that travel is needed, the client will reimburse G L Gracia, LLC at the standard IRS mile rate for the miles traveled.

4. PAYMENT. The Client shall pay G L Gracia, LLC: The amount required for starting the service and any state and federal filings in advanced and the rest will be paid at the end of the service with a 15 day grace period. G L Gracia, LLC reserves the right to charge penalties and interest or finance charges on services not paid when due.

5. EXPENSES. The Client shall: In addition to the Fees provided in Section 3, the Client agrees to reimburse G L Gracia, LLC for any out-of-pocket expenses incurred that include, but are not limited to, tax fees, postage, and miles.

6. RETAINER. The Client shall: Pay a retainer agreed between the parties, in case of a long term project, that shall act as an advanced payment on the Services provided by G L Gracia, LLC.

7. TERM. The Term of this Letter shall be: Per project or per filing, either state or federal, beginning on the date the service is requested and any advancements are paid, to the time the specific requested service is completed.

8. TERMINATION. In the event of a material breach, either party may terminate this Agreement prior to the end of the term by providing written or verbal notice to the defaulting party, at which time any unused portion of advanced payment or other payment for specific filings, will be returned from G L Gracia, LLC to the Client, minus the pay for the time spend in the project by G L Gracia, LLC.

9. CLIENT’S OBLIGATIONS. THE CLIENT SHALL BE SOLELY RESPONSIBLE FOR PROVIDING G L GRACIA, LLC WITH FINANCIAL INFORMATION RELATED TO THEIR PERSONAL AND/OR BUSINESS AFFAIRS INCLUDING, BUT NOT LIMITED TO, ALL MATERIALS, DATA, AND DOCUMENTS NECESSARY TO PERFORM THE SERVICES UNDER THIS LETTER. THE CLIENT ACKNOWLEDGES AND AGREES THAT THE ACCURACY OF FINANCIAL INFORMATION SUPPLIED TO G L GRACIA, LLC IS THE SOLE RESPONSIBILITY OF THE CLIENT AND G L GRACIA, LLC SHALL BE HELD HARMLESS FROM ANY LIABILITY RESULTING FROM THE ACCURACY OF THE FINANCIAL INFORMATION PROVIDED.

10. EMPLOYMENT STATUS. The Parties agree that G L Gracia, LLC shall provide the Services to the Client as an independent contractor and shall not be acting as or determined to be an employee, agent, or broker, unless the service requires it. As an independent contractor, G L Gracia, LLC shall be required to follow all requirements in accordance with the Internal Revenue Code which includes, and is not limited to, payment of all taxes levied for fees collected by the Client for payment of their employees, agents, brokers, and subcontractors. G L Gracia, LLC understands that the Client shall in no way withhold any amounts for payment of any taxes from G L Gracia, LLC’s accumulated fees for Services.

11. CONFIDENTIALITY. G L Gracia, LLC may, in the course of performing the Services hereunder, gain access to certain confidential or proprietary information of the Client. Such “Confidential Information” shall include all information concerning the business, affairs, products, marketing, systems, technology, customers, end-users, financial affairs, accounting, statistical data, documents, discussion, or other information developed by G L Gracia, LLC hereunder and any other proprietary and trade secret information of the Client whether in oral, graphic, electronic or machine-readable form. G L Gracia, LLC agrees to hold all such Confidential Information of the Client in strict confidence and shall not, without the express prior written permission of the client, disclose such Confidential Information to third (3rd) parties or use such Confidential Information for any purposes whatsoever, other than the performance of its obligations hereunder. The obligations under this section shall survive the termination or expiration of this Letter.

12. ASSIGNMENT. G L Gracia, LLC shall have no rights to assign any of their rights under this Letter or delegate the performance of any of the obligations or duties hereunder, without the prior written consent of the Client. Any attempt by G L Gracia, LLC to assign, transfer, or subcontract any rights, duties, or obligations arising hereunder shall be void and of no effect.

13. NOTICES. Any notices, bills, invoices, or reports required by this Letter shall be deemed received on the day of delivery if delivered by hand, standard mail, e-mail, or facsimile during the receiving party’s regular business hours.

14. GOVERNING LAW. This Letter shall be construed in accordance with and governed by Federal laws and those located in the State of Texas.

15. DISPUTE RESOLUTION. All disputes under this Letter shall be settled by arbitration in the State of governing law before a single arbitrator pursuant to the commercial law rules of the American Arbitrator Association. Arbitration may be commenced at any time by any party hereto giving written notice to the other party to a dispute that such dispute has been referred to arbitration. Any award rendered by the arbitrator shall be conclusive and binding upon the Parties hereto. This provision for arbitration shall be specifically enforceable by the Parties, and the decision of the arbitrator in accordance herewith shall be final and binding without right of appeal.

16. SEVERABILITY. If any provision of this Letter shall be held to be illegal, invalid, or unenforceable under present or future laws, such provisions shall be severable, and this Letter shall be construed and enforced as if such illegal, invalid, or unenforceable provision had never comprised a part of this Letter, with the remaining provisions of this Letter surviving in full force and effect.

17. LIMITATION OF LIABILITY. In no event shall either party be liable to the other party for any indirect, incidental, consequential, special, or exemplary damages incurred by the other party arising out of the services provided under this Letter, including without limitation business interruption, loss of or unauthorized access to information, or damages for loss of profits, even if such party has been advised of the possibility of such damages. In no event shall either party’s liability on any claim, loss, or liability arising out of or connected to this Letter exceed the amounts paid to G L Gracia, LLC during the period immediately preceding the event giving rise to such claim or action by the Client or the limits of G L Gracia, LLC’s professional liability policy.

18. INDEMNIFICATION. Each party shall at its own expense indemnify and hold harmless, and at the other party’s request defend such party affiliates, subsidiaries, and assigns, its respective officers, directors, employees, sublicensees, and agents from and against any and all claims, losses, liabilities, damages, demand, settlements, loss, expenses, and costs, including attorneys’ fees and court costs, which arise directly or indirectly out of or related to any breach of this Letter or the gross negligence or willful misconduct of a party’s employees or agents.

19. ENTIRE LETTER. This Letter is the final, complete, and exclusive agreement of the Parties with respect to the subject matter hereof and supersedes and merges all prior or contemporaneous representations, discussions, proposals, negotiations, conditions, communications, and agreements, whether written or oral, between the Parties relating to the subject matter hereof and all past courses of dealing or industry custom. No modification of or amendment to this Letter shall be effective unless in writing and signed by each of the Parties.

20. ADDITIONAL TERMS AND CONDITIONS.

21. WAIVER. The waiver by either party of a breach of or a default under any provision of this Letter shall not be effective unless in writing or verbal and shall not be construed as a waiver of any subsequent breach of or default under the same or any other provision of this Letter, nor shall any delay or omission on the part of either party to exercise or avail itself to any right or remedy that it has or may have hereunder operate as a waiver of any right or remedy.

Current Price List

If you are a current client, we will respect the prices and discounts offered to you for the current year, otherwise the list below will apply.

All services are a la carte and are performed following the price schedule found here. Please contact us if you would like to execute a contract for continuos service, instead of pay per project.

| Services | Price |

|---|---|

| Bookkeeping (per hour) | $50.00 |

| Electronic filing of 1099 and W-2 (per form) | $7.00 |

| LLC Creation (state fee not included) | $600.00 |

| LLC Dissolution (state fee not included) | $300.00 |

| State Sales and Franchise Tax Filing (Per filing) | $50.00 |

| Tax Forms for Individuals | Price |

|---|---|

| Form 1040 Individual Income Tax Return | $150.00 |

| Additional Family Member Needing a Separate Individual Return And/Or Partner in Partnership | 20% off of total price |

| W7 Request/Renewal for Individual Taxpayer Identification Number (ITIN) | $100.00 |

| Itemized Deductions | $50.00 |

| Interest and Dividend Income | $20.00 |

| Business Income (per business) for Sole Proprietor | $50.00 |

| Capital Gains | $20.00 |

| Rental Income | $50.00 |

| Farming Income | $50.00 |

| Foreign Tax Credit | $25.00 |

| Application for Change in Accounting Method | $180 |

| Sales of Business Property | $50.00 |

| Form 4868 Application for Automatic Extension of Time to File (Credited to price of return) | $50.00 |

| Tax Forms for Partnerships | Price |

|---|---|

| Partnership Income Tax Return | $250.00 |

| Partnership E-File Authorization Electronic Signature | $5.00 |

| Partner Percentage of Income and Expense | $18.00 |

| Letters to Partners (per letter) | $7.00 |

| Other Specific Requirements (per hour) | $50.00 |